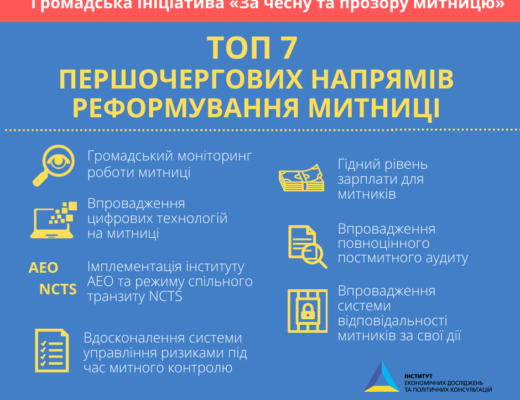

March 23, 2021 in the framework of the project “Support to the public initiative” For fair and transparent customs “, implemented by the NGO” Institute for Economic Research and Policy Consulting “(IER) with the support of the European Union, Renaissance Foundation and ATLAS Network in cooperation with the Ministry of Finance , The State Customs Service, the EU Public Finance Management Support Program in Ukraine (EU4PFM) and the Reform Support Team (RST) at the Ministry of Finance of Ukraine held a remote seminar for participants and partners of the public initiative “For Fair and Transparent Customs” on practical aspects of obtaining status of Authorized Economic Operator (AEO).

This is the first seminar organized within the framework of the training program for participants and partners of the public initiative “For Fair and Transparent Customs” and is implemented by the IER within the framework of the mentioned project. At the same time, this is the fifth event that EU4PFM together with partners held for Ukrainian business associations on this topic.

The participants heard welcoming speeches from the Project Manager for Support of the Public Initiative “For Fair and Transparent Customs”, the IER Executive Director – Oksana KUZIAKIV, and the key EU4PFM customs expert – Vityanis ALISHAUSKAS.

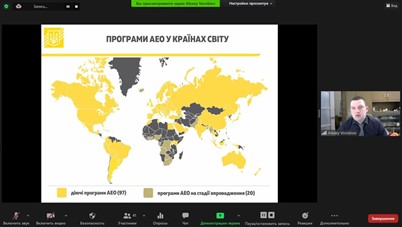

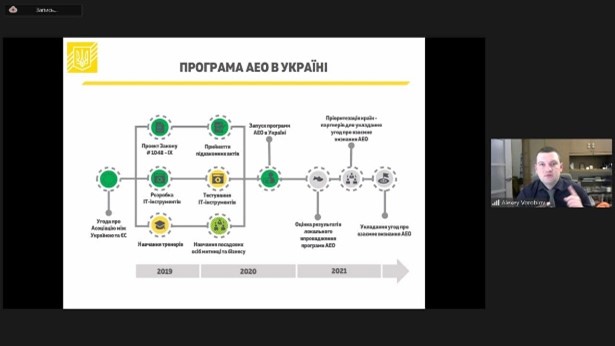

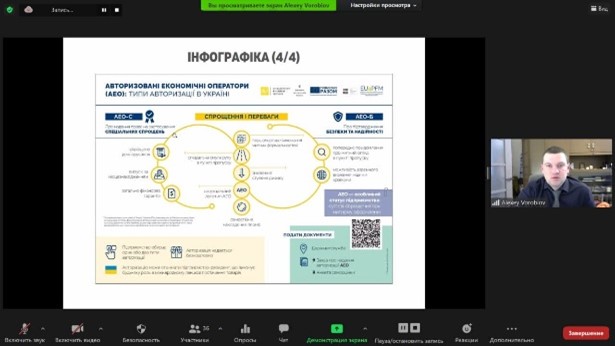

During the event, its participants learned about the AEO program in the world and in Ukraine, its economic benefits, types of authorization, procedures, procedures and criteria for obtaining authorization. Participants also had the opportunity to pre-formulate questions that interested them and ask them directly during the seminar to the speaker – expert on the implementation of the AEO of the EU4PFM Program Olexii VOROBYOV. All questions were answered comprehensively and professionally.

The event was attended by about 40 representatives of business associations, businesses and NGOs.

Among the participants were representatives of public organizations and business associations – members of the Public Initiative “For Fair and Transparent Customs”, as well as their partner organizations who expressed a desire to participate in the seminar.

Including:

45% – business environment and entrepreneurs (LLC, LLC, PJSC, PJSC, individual entrepreneur);

40% – public organizations and business associations;

10% – representatives of regional state administrations, regional customs and lawyers *;

2% – representatives of higher education institutions.

Materials Link